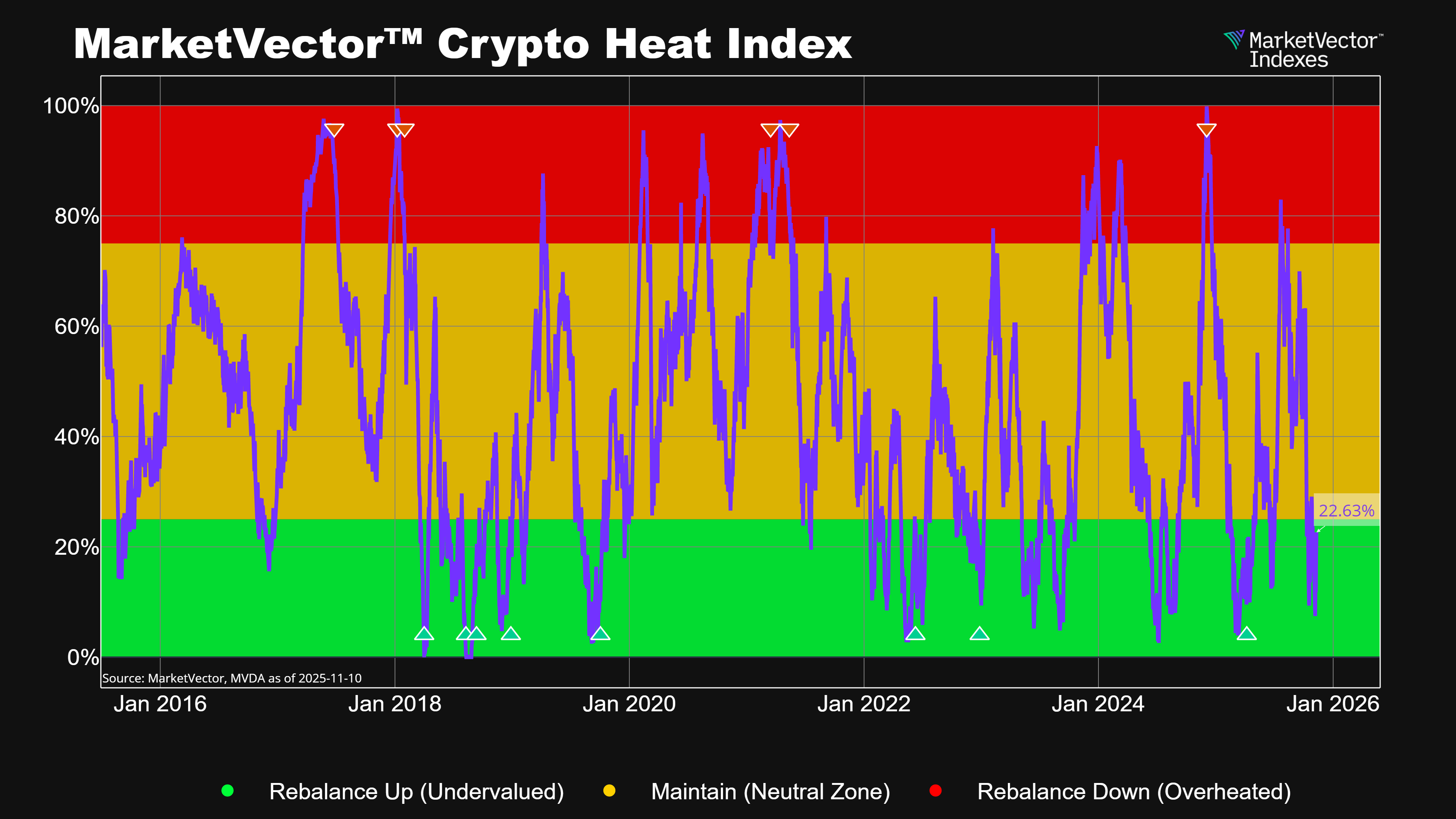

On September 17, 2025, the SEC approved generic listing standards for spot commodity- and digital asset-based exchange-traded products (ETPs) proposed by Cboe BZX, Nasdaq, and NYSE Arca1.

This marks a structural shift from the SEC’s historic case-by-case approval process — where reviews could last up to 240 days — to a standardized fast-track framework. Think of flying business class now instead of economy. For issuers, this reduces cost and uncertainty and significantly shortens time-to-market. For investors, it broadens access to regulated crypto exposure.

We believe this is the most important regulatory development for digital assets since the approval of the first Bitcoin ETFs.

Get the latest news & insights from MarketVector

Get the newsletterRelated: