The Changing Landscape of Competitive Advantage

In recent years, the “Magnificent 7”—Apple, Microsoft, Alphabet (Google), Amazon, Nvidia, Meta, and Tesla—have dominated global equity markets. These tech titans, often hailed as the backbone of modern innovation, owe their rise to proprietary software, vast data ecosystems, and elite engineering teams. Together, they’ve become the heavyweights of the S&P 500, commanding enormous influence over the broader market.

But we’re entering a new era—one where code-based advantages are rapidly losing their edge.

The Rise of AI and the Collapse of Code Moats

Artificial Intelligence is leveling the playing field at unprecedented speed. What once required massive teams, years of R&D, and deep capital reserves can now be replicated by a solo developer using generative AI tools. Software solutions that once formed nearly impenetrable moats are now easily cloned or improved upon in a matter of days.

Jordi Visser, in a recent Substack article, captured this paradigm shift beautifully. He argued that AI is not just enhancing capitalism—it’s democratizing it. Tools like ChatGPT, GitHub Copilot, and other AI-assisted platforms are turning complex software creation into a near-commodity. The scarcity of top-tier engineering talent, once the crown jewel of Big Tech, is no longer the gatekeeper it once was.

Bitcoin: The Unshakable Outlier

Unlike the Magnificent 7, Bitcoin doesn’t rely on proprietary code or corporate innovation cycles. It’s not a company with a product roadmap, R&D division, or earnings report. Its strength lies in immutability, decentralization, and belief.

Bitcoin’s true moat is psychological—not technological.

Its narrative is simple yet powerful: digital scarcity in a world of infinite money. Social consensus protects it. There is no central authority, no CEO to fire, and no quarterly earnings to miss. It doesn’t need to compete on performance or feature updates. Like gold, it is valuable because people believe in it—and that belief is growing.

Why the BTC-to-Mag7 Ratio Matters

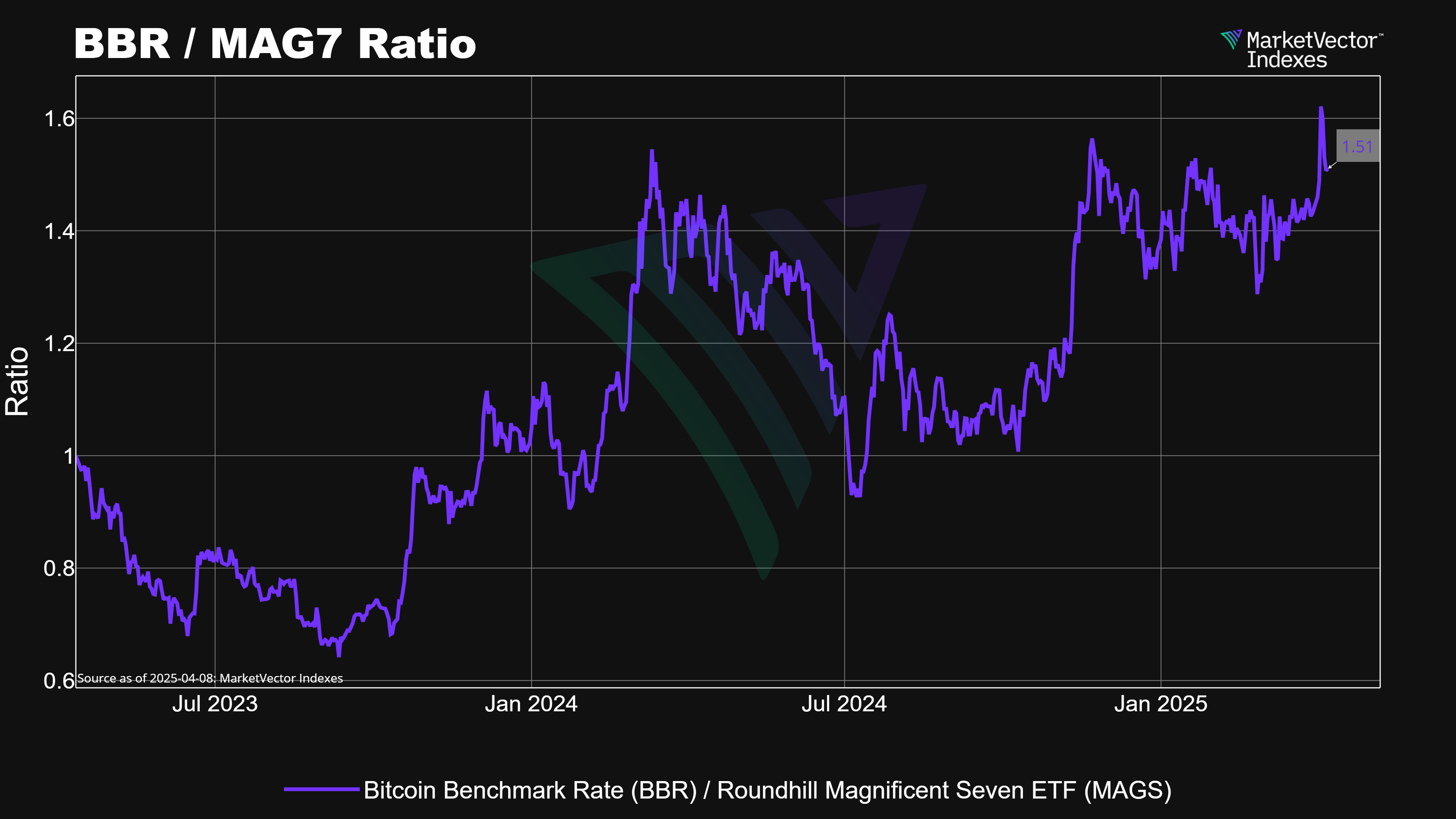

A closer look at market data reveals that the Bitcoin-to-Mag7 ratio is forming a classic cup and handle pattern—a bullish technical signal in chart analysis. But beyond the chart, it tells a deeper story: Bitcoin is quietly gaining ground against the market's most celebrated tech names.

This divergence is not accidental—it's structural.

Source: MarketVector. Data as of April 6, 2025.

Macro Trends Fueling the Shift

Several macroeconomic factors are strengthening Bitcoin’s position as a non-correlated hedge:

- Trade Wars and Tariffs: While traditional tech companies are exposed to global supply chains and cross-border trade restrictions, Bitcoin operates outside national jurisdictions. Geopolitical tensions have little effect on its decentralized structure.

- Central Bank Policy: As monetary authorities face pressure to ease policies amid slowing growth, liquidity injections could benefit Bitcoin disproportionately. Unlike equities, it doesn't suffer from declining profit margins during rate cuts.

- Asset Reclassification: Historically, Bitcoin has been lumped with high-risk assets. But that narrative is shifting. As investors search for macro hedges in an uncertain world, Bitcoin is being re-evaluated—not as a tech bet, but as a digital alternative to gold.

Code is Easy to Copy—Belief is Not

In today’s world, software is becoming easy to replicate. But decentralized trust, hard-coded scarcity, and ideological conviction cannot be forked. Bitcoin doesn’t win because it evolves faster than Big Tech—it wins because it doesn’t have to.

Where tech companies must continuously out-innovate competitors just to stay relevant, Bitcoin remains timeless. Its value proposition hasn’t changed since its creation: a fixed-supply, borderless, decentralized money system immune to corporate mismanagement or government manipulation.

The Future of Moats: From Technology to Trust

We’re witnessing the collapse of traditional moats. The new competitive edge isn’t built on secret algorithms or intellectual property—it’s built on narrative strength, community, and belief.

Bitcoin represents a shift from performance-driven to principle-driven value. In an era of accelerated disruption, the most resilient assets may not be those that change fastest, but those that remain unchangeable.

Final Thoughts: Bitcoin Over the Magnificent 7?

While the Magnificent 7 will likely remain dominant forces for the foreseeable future, their technological advantage is clearly eroding. AI is flattening the innovation curve. Regulatory risk is rising. And macro headwinds are gathering.

Bitcoin, meanwhile, is quietly strengthening its position—not as a competitor to tech stocks, but as an alternative to the entire system.

In the battle of Bitcoin vs. Big Tech, the deciding factor might not be who builds the best product, but who holds the strongest belief.

Get the latest news & insights from MarketVector

Get the newsletterRelated: