Ecuador is a country located in South America, bordered by Colombia to the north, Peru to the south and east, and the Pacific Ocean to the west. It gained independence from Spain in 1822 as part of Gran Colombia and became fully independent in 1830, when Gran Colombia dissolved.

Geographically, Ecuador is divided into four distinct regions:

1. Sierra (the highlands),

2. Costa (the coastal region),

3. Oriente (the eastern Amazon jungle), and

4. The Galápagos Islands.

More than 90% of Ecuador’s population of approximately 18 million lives in either the Sierra or Costa regions. The capital, Quito, located in the Sierra, serves as the political center of the country. Meanwhile, Guayaquil, situated in the Costa, is the commercial and industrial hub. These two regions have long been characterized by a deep socio-cultural and political divide, marked by distinct regional identities, entrenched stereotypes, and ongoing competition for political and economic influence.

Although Ecuador was once considered one of the more peaceful countries in Latin America, the situation has deteriorated since 2020. Increasing instability, violence, and political tension have emerged, largely driven by escalating conflicts between drug cartels.

A Divided Market: Ecuador’s Dual Exchange Structure

This broader instability has had interesting implications for Ecuador’s stock market. The country has two stock exchanges:

· The Quito Stock Exchange (Bolsa de Valores de Quito, BVQ), and

· The Guayaquil Stock Exchange (Bolsa de Valores de Guayaquil, BVG).

Many of the more than 60 major stocks are dual-listed on both exchanges, and trading practices are largely similar. However, this structure leads to fragmented liquidity and redundant infrastructure.

Although there have been calls for unification or greater integration between the two exchanges to enhance market efficiency and liquidity, the current setup persists due to historical traditions and entrenched regional dynamics.

Each exchange also maintains its own indexes:

· The IGCE is published by the BVQ for its market.

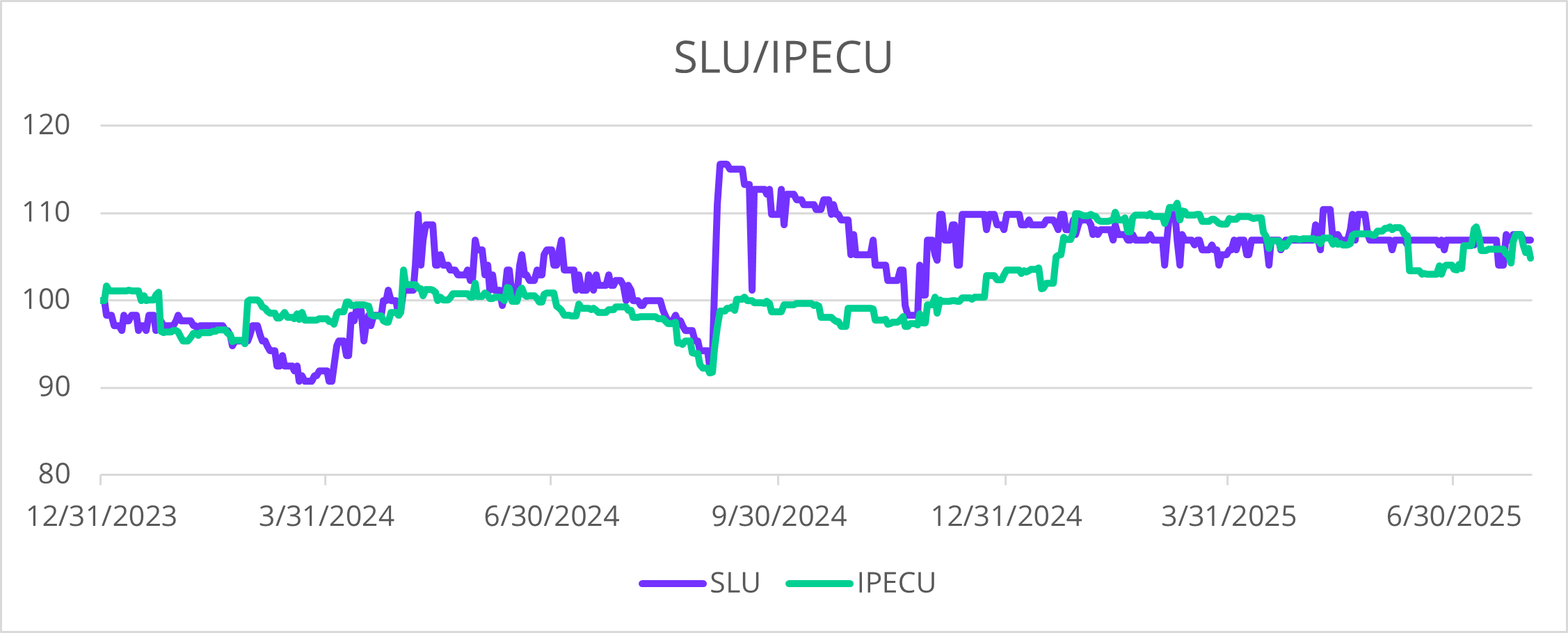

· The BVG publishes its own BVG Index, as well as the IPECU and IRECU indexes, which are price and total return indices covering both markets.

SLU: The Dominant Player in an Illiquid Market

Unlike other countries with multiple major exchanges—such as the United Arab Emirates or Bosnia-Herzegovina—MarketVector considers Ecuador’s stock market as one due to the significant overlap in listings. Consequently, MarketVector does not cover the BVQ and BVG separately in the construction of the MarketVector™ Total Global Equity Index.

As a result, the index includes only Corporación Favorita C.A. (ticker: SLU, listed on both exchanges), a diversified conglomerate with operations spanning retail, real estate, electricity generation, food and essential goods production, commerce, and hardware. SLU is the largest company by float-adjusted market capitalization and by far the most liquid stock in Ecuador, with an average daily trading volume nearing USD 100,000. In contrast, most other stocks trade less than USD 10,000 per day.

Source: MarketVector. Data as of July 30, 2025.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

.png)