For decades, the U.S. dollar has dominated the global financial system not just through trade and Treasury markets, but by being the default currency of trust. That trust is being tested in a new arena: the Internet of value.

But rather than resisting, U.S. policymakers now appear to be doing something surprising—and frankly, quite strategic.

They embrace decentralized finance (DeFi) and stablecoins as the next chapter in American monetary supremacy. If the 20th century belonged to the Fed and the SWIFT network, the 21st may belong to Ethereum, Uniswap, and on-chain dollars.

From Crackdowns to Catalyst

The last five years in U.S. crypto policy can be summed up in one word: resistance.

But since the beginning of 2025, there has been a tectonic shift.

- Paul Atkins, the new SEC chair, has openly endorsed self-custody, staking, and DeFi protocol innovation.

- The administration’s economic advisors—most notably Scott Bessent—have linked stablecoins to a national monetary strategy.

“We are going to keep the U.S. the dominant reserve currency in the world, and we will use stablecoins to do that.”

— Scott Bessent, United States Secretary of the Treasury

It’s not just talk. This emerging policy regime recognizes that if the dollar is to stay dominant, it must be dominant on-chain.

Why Stablecoins Are the Dollar’s Trojan Horse

Stablecoins like USDT and USDC are already transforming global markets. They are:

- Held and used internationally, outside of U.S. banking rails.

- Settled instantly, 24/7, without the need for intermediaries.

- Backed largely by short-dated U.S. Treasuries, exporting American fiscal credibility.

As of mid-2025, over 99.5% of global stablecoin volume is denominated in U.S. dollars[1]. The U.S. didn’t have to launch a CBDC. The market took care of it for them.

Stablecoins are a Trojan horse for dollar hegemony. But to circulate, they need infrastructure.

Source[1]: https://www.coingecko.com/en/categories/stablecoins#key-stats

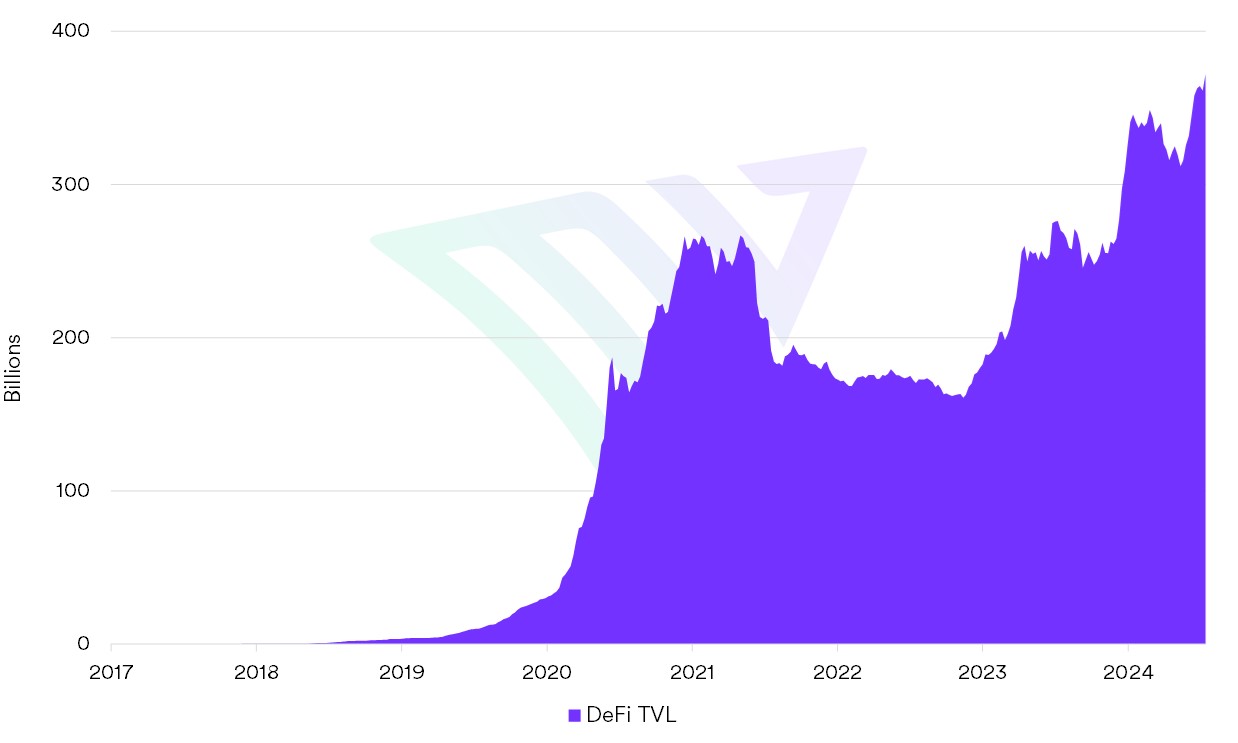

DeFi: The Infrastructure of Monetary Power

Here’s where DeFi enters. Dollar-backed stablecoins need functional markets: exchanges, lending platforms, and collateralized instruments. They need Ethereum and its ecosystem of smart contract-based financial primitives.

DeFi isn’t some fringe experiment anymore—it’s the plumbing for the internet’s dollar economy.

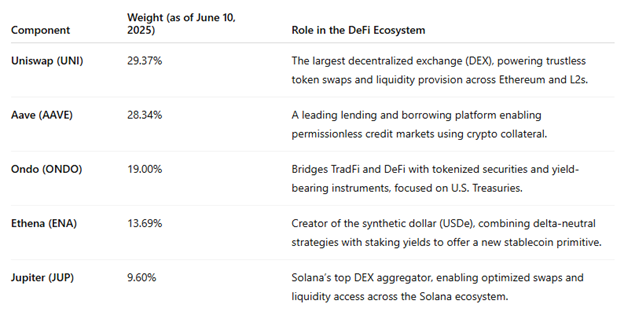

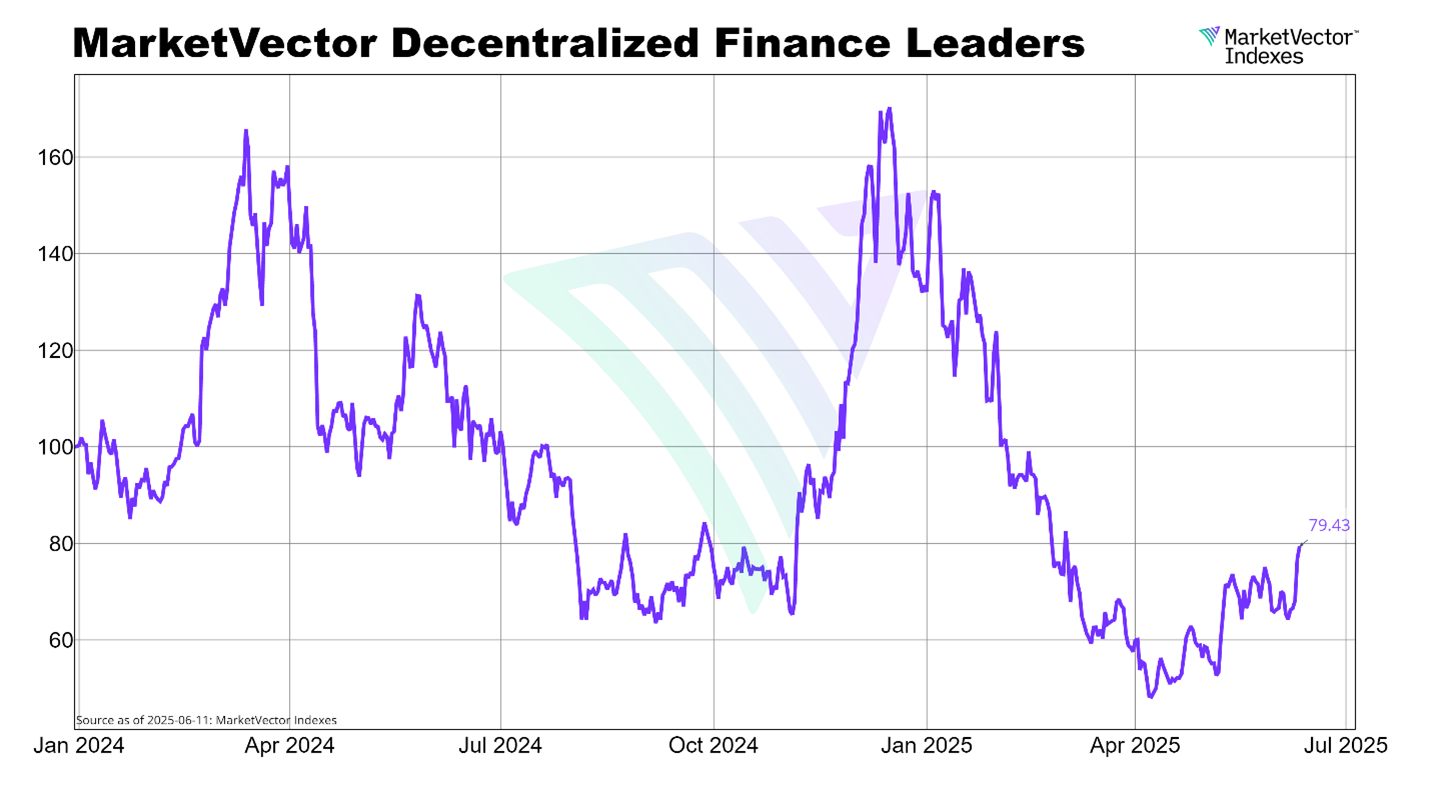

To track this evolution, one doesn’t need to look far. The MarketVectorTM Decentralized Finance Leaders Index (MVDFLE) offers a curated benchmark of the largest and most liquid DeFi protocols—many of which will form the backbone of this on-chain monetary future. The index is also dominated by the Ethereum native token.

A Benchmark for the DeFi Dollar Age

The MVDFLE index includes five core DeFi protocols:

These are the tools for global users interacting with dollar-denominated crypto finance.

While many of these names have experienced price drawdowns YTD (e.g., UNI -50%, ENA -63%), the fundamentals are improving: TVL is growing, staking queues are building, and ETF flows into ETH continue to rise.

Source: Token Terminal. Data as of June 12, 2025.

These names reflect the move away from the meme coin “casino” and back toward utility, settlement, and yield.

Why Investors Should Pay Attention

This isn’t just about regulation. It’s about portfolio construction in an era of geopolitical digitization.

Why Ethereum Matters:

- ETH is the dominant base layer of on-chain dollars.

- The ETH/BTC ratio is a leading signal for altcoin season and risk appetite.

- With ETH ETFs gaining traction and staking permission under review, ETH is morphing from a speculative asset into a yield-bearing macro allocation.

Why MVDFLE Names Matter:

- These are the protocols positioned to intermediate trillions in stablecoin flows.

- Lending protocols like Aave are becoming the “on-chain banks.”

- Uniswap is the de facto exchange venue for tokenized USD liquidity.

- ONDO is tokenizing RWAs and hence, bringing USD yield on-chain

- Ethena is a rising star in the stablecoin space

The best part? Valuations have room to rerate. We are in the trough of disillusionment for DeFi—a familiar pattern seen in every technological cycle.

Source: MarketVector. Data as of June 12, 2025.

Think of 2003 post-dotcom. The market wrote off Amazon. Smart money bought infrastructure.

We’re there now with DeFi.

Final Thought: The Dollar Will Live On-Chain

The U.S. has figured it out.

It doesn’t need to ban crypto. It doesn’t need to build its tech stack. It just needs to harness the rails that already exist—and ensure they move dollars.

DeFi protocols are being recast not as rebels, but as strategic digital institutions. And the MVDFLE index shows you where that value is accruing.

Stablecoins are the export.

Ethereum is the infrastructure.

The dollar is the brand.

The Internet of value has already chosen its reserve currency. It’s the dollar, but programmable.

Get the latest news & insights from MarketVector

Get the newsletterRelated: