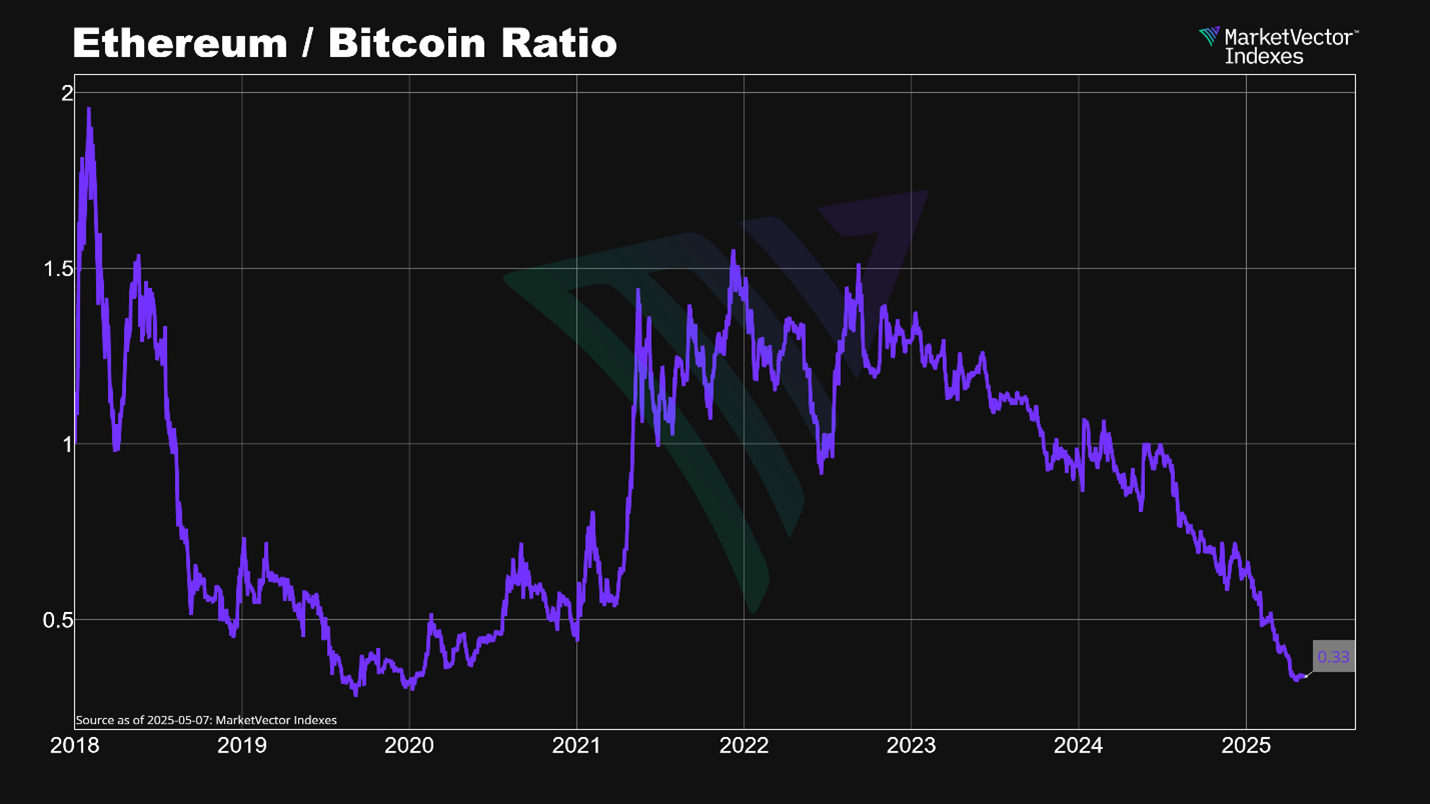

Introduction: ETH Has Lagged—But That’s Not the Whole Story

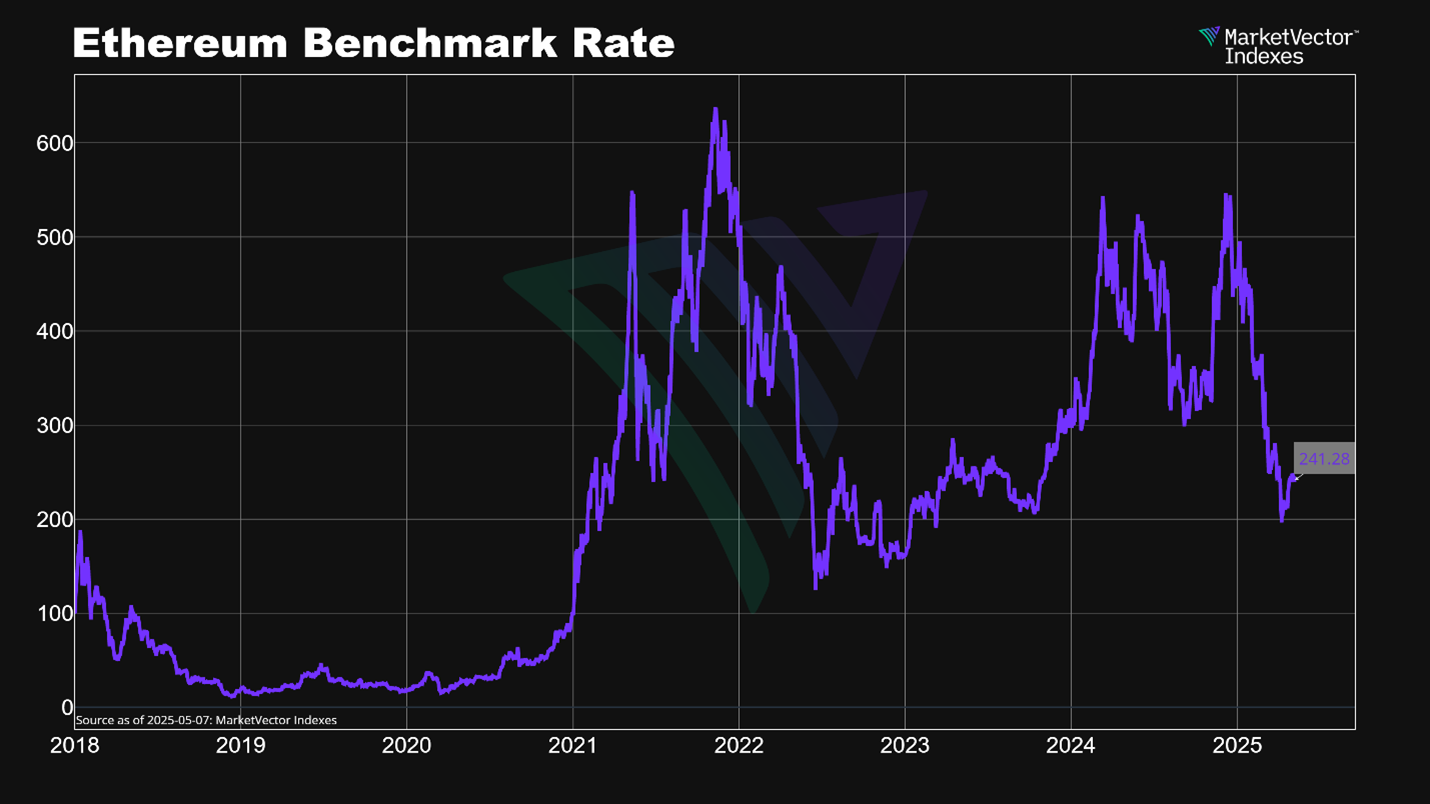

Ethereum has been a disappointment in many portfolios over the past year. Despite a favorable macro backdrop, the launch of Bitcoin and Ethereum ETFs, and a surge in institutional interest in digital assets, ETH has underperformed—both in absolute terms and relative to Bitcoin and even newer alt L1s like Solana.

Source: MarketVector. MarketVectorTM Bitcoin Benchmark Rate (BBR)/MarketVectorTM Ethereum Benchmark Rate (EBR).

This has led many investors to either reduce their exposure or avoid Ethereum altogether. But that may be a mistake.

The fundamental investment case for ETH is not only intact—it’s strengthening. Regulatory clarity, protocol upgrades, the evolution of staking, and Ethereum’s central role in tokenized finance all point to a very different outlook than what recent price action implies.

For institutional allocators, now may be one of the most contrarian—and opportunistic—times to revisit Ethereum.

The Performance Trap: Price vs. Positioning

In investing, price is often the least useful signal during inflection points. The same institutions that ignored Bitcoin under USD 10K are now loading up post-ETF approval. ETH could be next.

The current market structure tells us this underperformance isn’t due to a failure of the Ethereum thesis—it’s a reflection of narrative dominance (Bitcoin ETFs), short-term structural overhangs, and the lack of immediate catalysts. But the catalysts are forming.

Source: MarketVector. MarketVectorTM Ethereum Benchmark Rate (EBR).

A New Cycle Is Forming—And ETH Is Core to It

Matt Hougan, CIO at Bitwise, made an important observation recently: the classic “four-year crypto cycle” is likely dead. What’s replacing it is an institutional supercycle—driven by regulatory clarity, capital inflows, and the integration of crypto into traditional finance.[1]

Bitcoin is leading that phase. Ethereum is preparing to follow.

Two things need to happen for ETH to reprice materially higher:

- U.S. regulatory green lights—especially for stablecoins and market structure.

- Ethereum Foundation execution—with roadmap clarity and upgrade delivery.

If these materialize, Ethereum could shift from underperformer to outperformer—fast.

ETH Is Not Just a Token—It’s Financial Infrastructure

One of Ethereum’s biggest perception problems is that investors still view it as “an altcoin.” But ETH is the native asset of a financial operating system.

It secures the world’s largest programmable blockchain. It underpins stablecoin settlement (USDC, USDT), powers DeFi, and is rapidly becoming the base layer for tokenized treasuries, Real World Assets (RWAs), and institutional fund structures.

BlackRock, Franklin Templeton, and other major asset managers are not building on Solana or Avalanche. They’re choosing Ethereum.

If you believe tokenized assets and digital cash will be core to future finance, it’s hard to ignore Ethereum.

Staking: Ethereum’s “Digital Bond Market”

Ethereum’s proof-of-stake design allows ETH holders to earn a yield by securing the network—similar to fixed-income dynamics in traditional portfolios.

Liquid staking has made this even more accessible. Institutional funds are integrating liquid staking tokens (LSTs), allowing investors to earn yield while retaining asset liquidity.

This makes ETH a unique digital asset: it has growth potential, a real yield, and infrastructure utility—traits few assets in any class can claim simultaneously.

Protocol Upgrades: Pectra and Beyond

Ethereum’s most recent upgrade—Pectra—didn’t generate headlines, but its implications are significant. It addressed long-standing user experience issues, expanded network capacity, and introduced meaningful improvements for staking infrastructure. These technical upgrades may seem arcane, but they’re quietly laying the groundwork for Ethereum’s long-term institutional utility.

Here’s what changed—and why it matters:

- EIP-7702: Smart Wallets for Everyone

Traditionally, Ethereum wallets could only send and receive assets. This upgrade gives all wallets smart contract-like powers. That means:- Users can bundle transactions (fewer pop-ups and confirmations)

- Apps can pay transaction fees on behalf of users

- Gas can be paid in stablecoins—not just ETH

→ This dramatically improves the user experience, particularly for those used to seamless fintech apps.

- EIP-7691: More Data, Lower Costs

Ethereum supports rollups (like Arbitrum and Optimism) that scale the network by posting data to Ethereum in “blobs.” Pectra doubled Ethereum’s blob capacity, reducing congestion and improving cost-efficiency for these Layer 2s.

→ This helps Ethereum scale without compromising on decentralization, and keeps fees low for users. - EIP-7251: More Efficient Staking for Institutions

Previously, each validator had to stake exactly 32 ETH. This meant large stakers had to run many separate validators. Now, with increased validator caps (up to 2048 ETH and beyond), institutions can consolidate.

→ This reduces operational complexity and improves the economic efficiency of ETH staking at scale.

Taken together, these changes make Ethereum more scalable, more intuitive to use, and more institution-friendly—exactly the direction it needs to go as tokenized finance continues to grow.

From Disbelief to Adoption: Ethereum’s Role in the RWA Boom

RWAs like tokenized treasuries and money market funds are exploding—many issued directly on Ethereum. Securitize, BlackRock, and other institutions are leveraging ETH-based infrastructure to build regulated financial products with on-chain settlement.

ETH is not competing to be the “fastest chain”—it’s positioning itself as the most credible, neutral, and regulated execution layer.

Think of it this way: Ethereum isn’t trying to be the next Solana. It’s trying to be the decentralized Nasdaq.

Valuation: If RWAs Hit USD 1 Trillion, What’s ETH Worth?

Here’s the simple investment framing:

- Stablecoins are at ~USD 250 billion.

- Tokenized treasuries and RWAs are accelerating.

- DeFi protocols continue to attract capital.

If stablecoins reach USD 2.5 trillion and RWAs USD 1 trillion over the next 3–5 years—as many analysts expect—then what should ETH be worth?

The current price doesn’t reflect that future. Not even close.

Final Thought: Time Horizons Matter

Short-term volatility and underperformance can obscure long-term shifts. Ethereum’s recent stagnation may feel discouraging, but when evaluated through the lens of infrastructure adoption, regulatory normalization, and on-chain financial services, the story is far from over.

It may, in fact, be just beginning.

[1] https://coinmarketcap.com/academy/article/5b8d7c05-9466-4c94-a3a8-64eea75cdd57

Get the latest news & insights from MarketVector

Get the newsletterRelated: